Compound interest is the holy grail of building wealth over the long term. In fact, world renowned physicist referred to compound interest as the “eighth wonder of the world.”

Put simply, compound interest is interest earned on the principal amount you invest plus interest on the interest earned on the principal amount. Sounds complex? Let’s look at an example.

John invests $5,000, which pays an annual interest rate of 5%. At the end of Year 1, his investment will be worth $5,250 ($5,000 x 5%). At the end of year 2, he will earn interest of $262.50 ($5,250 x 5%) and his investment will be worth $5,512.50 ($5,250 + $262.50). Using the same principles of compounding, John’s investment will be worth $8,144.47 at the end of Year 10, assuming that he did not make any withdrawals.

Now, let’s assume that following his investment of $5,000 in Year 1, John decides to invest $500 monthly for the next 10 years, that is, $6,000 annually. His total investment over 11 years would be $65,000 [$5,000 + ($6,000 x 10)]. At the end of 11 years, his investment would be worth $83,611.83, for a compounded rate of return of 28.63% over the period. Therein lies the magic of compound returns.

In reality, compound interest works best over the long term if you use an “invest it and leave to it grow” strategy.

Another major benefit of compound interest is that the earlier you start saving, the more wealth you can accumulate over the long term.

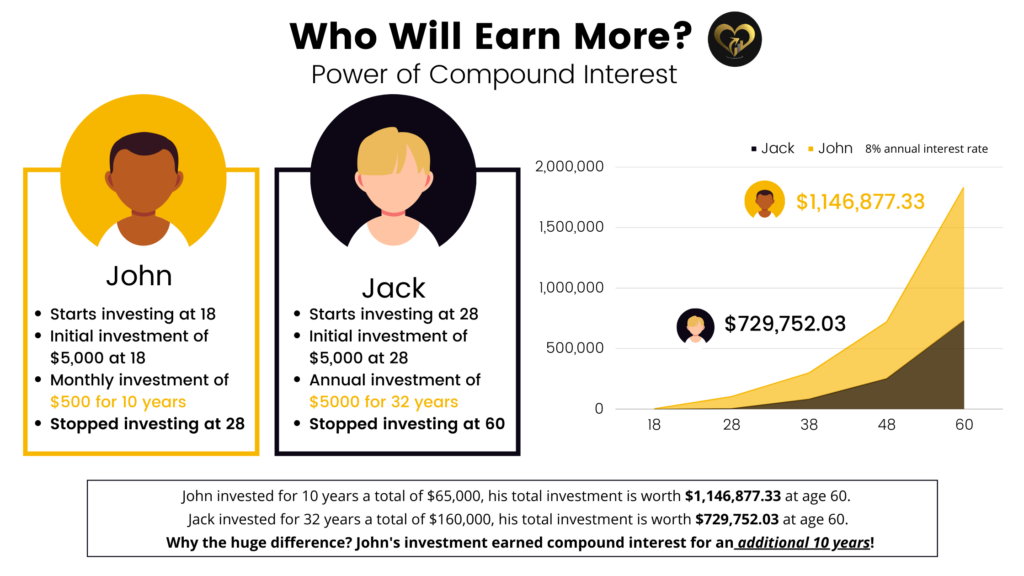

Let’s look at two cases to illustrate the power of compounding when you start to save early versus starting later. Both John and Jack earned the same rate of return of 8% on their investment.

- John made an initial investment of $5,000 at age 18, followed by an investment of $500 per month for a period of 10 years. In total he invested a total of $65,000. He earned a rate of interest of 8%. At age 28, he stopped investing and allowed his investment to grow for 42 years, until he is ready to retire at age 60.

- At age 60, his total investment of $65,000 was worth $1,146,877.33, though he never invested another penny after age 28.

- On the other hand, Jack invested the same amount of $5,000 as John but does so 10 years later at age 28. He continued to invest $$5,000 annually for a period of 32 years until he is ready to retire at age 60. In total, Jack invested $160,000 and earned a rate of return of 8%.

- At age 60, Jack’s total investment of $160,000 was worth $729,752.03, far less that John’s.

- What is important to note is that although John invested $65,000, his investment is worth $1,146,877.33 at age 60 when he is ready to retire at age 60. Comparatively, Jack invested $160,000 and his investment id worth $729, 752.03 at age 60.

- John invested for only 10 years and stopped investing, whereas Jack invested for 32 years until he was ready to retire at age 60.

- The dramatic difference between John’s and Jack’s total investment value illustrates the power of compounding when you start to invest early. John started investing 10 years earlier and his money benefitted from the power of compounding for a longer time.

Disclaimer: Do Your Own Research. You should take independent financial advice from one of our professionals and/or independently research and verify, any information that you find on our Website and wish to rely upon, whether for the purpose of making an investment decision or otherwise.