During The Covid-19 Pandemic

COVID-19 Pandemic has affected our daily lives more than anything. Not only wearing the mask, or maintaining social distancing is annoying, but it has negatively affected our financial situations. Although many financial institutions have supported through allowing deferred payments or lowering the minimum balances but still many of us has seen drop in our credit score.

In order to improve your credit score during the period of COVID, there are essentially four main steps that you will need to take. But first, let’s look into the following:

What is a Credit Score?

Just to remind, a credit score is paramount for anyone interested in borrowing money from a financial institution, whether it be for the purpose of buying a house, purchasing a car, getting a credit card, etc. A credit score is simply a number which can change every month depending on how good you are in managing your credit.

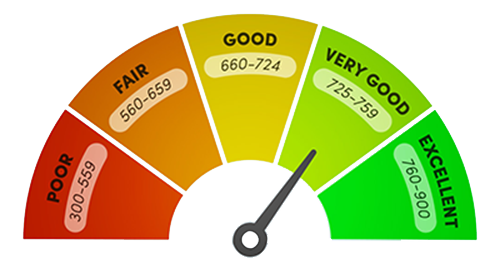

It’s always important to have a high credit score than a low credit score; the higher the credit score, the lower the risk you, as a lender will face. A credit score has a total of 3 digits and it can range from any number from 300 to 900.

What is a Good Credit Score Number?

The credit score is further divided into ranges to define the quality of your number. If your score is above 660, you are considered to have a good credit score. However, having a score of 700 and above is good enough to get credibility and greater chances of approval.

On the other side, if your score is in the range of 560 to 659, this means you have to take certain decisions to improve your score. If you are below 560, there is a fundamental issue with you borrowing or managing your debt. In this case, you will need to seek some professional help right away and think of ways to rebuild and repair your credit ASAP.

Why Should We be Concerned?

A strong credit score or credit history will not only allow you to get access to loans and credit facilities, but also will qualify you for some great deals like low interest rates, rewards and cash back, etc. On that note, it is very important that you understand your ratings in your credit report; the credit report will have a combination of alphabet letters and numbers.

For instance, the alphabet letters are as follows: “R” is for revolving, “M” is for mortgage, “I” is for installment payment. The numbers start from 1 to 9. Number 1 will represent the notion, “you pay as agreed,” along with continuing to pay the minimum payment of your credit. Number 2 represents a delay in payment. So to get an understanding, if you see R9 on your credit report, this indicates that a revolving debt has been placed for collection or that a bankruptcy has been recorded.

How can you Improve your Credit Score

So you might be wondering, how can I improve my score and rating? So going back to where we started, let’s look at the four main steps you can take to improve your credit score:

1. Calculate a Practical Budget for Yourself

To improve the credit score, you need to have an understanding of your financial position. For this, the first step is to determine your income and source of income. Once you figure out all the sources of income, you will then need to think of yourself in a scenario of what will happen to you if one or more sources of income stops, for whatever reason that maybe.

A good way to track your income is to keep a record of it by writing it all down (example, how much income are you expecting to make for the next 3, 6, 12 months?). At the same time, write down all the essential and necessary expenses that you need to operate a normal lifestyle; we call this “your wants and desires.” Of course, it’s much easier said than done. In order to really see a difference, you will have to collect all your bills, including your online subscription – Netflix, Amazon Prime etc., and calculate your total expenses.

There are several free tools available to keep a record of your expenses, including our My LifePlan iOS App on App Store and My LifePlan Android App on Google Play; these tools are free to use and can show how much an average person spends vs. how much you spend.

2. Manage Your Credit Cards

A smart way to manage your current credit is to pay off the high-interest cards or keep the balance of credit cards below 30% of the limit. One of the ways you can manage your credit cards is to write all the credit cards you have, including your credit limits and see how much is outstanding to owe.

Take some time to figure out how much interest is on your card(s) and how much your monthly payments come out to be. This will help you in deciding which cards to pay off first and how you will be paying off the cards.

The most important thing is to create a plan and stick to it. During this COVID time, most of the financial institutions are giving relief to clients, such as lower interest rates, differing payments and differing interest and principle. Do take advantage of this to manage your cash flow and debts.

3. Do Not Skip Payments

I cannot stress enough the importance of making your payments on time. If you’re not able to, try to pay at a reasonable time and continue to pay the minimum amount in order to prevent any interest charges.

Especially with the Covid pandemic crisis, most people think the best solution is to defer payment to their loans and/or credit companies. Before you act quickly, be smart about the options you have and do check the fine prints from what the financial institutions are actually giving you. You need to ask yourself that if you differ payments,

- How will I be able to pay more amount with accumulated interest?

- Is this really the smart thing to do?

- Would I be able to manage the increased amount of payment owing in the future?

These are all questions that we need to ask ourselves before we hastily decide to jump on differing payments.

I would suggest that you do an honest and detailed credit analysis of yourself, understand where you stand and then put together a plan; once you have a plan in place, you can then negotiate with your lending providers to lower the interest rate or differ the payments as you prefer. Most importantly, do not forget to document your conversation for future references.

4. Do Not Close Credit Accounts

Last but not least, do not close the credit accounts after you pay them off, unless there is a maintenance, an annual fee or an inactive account fee. It will assist you to lower the overall credit utilization and improve your credit.

Another alternative way to achieve this is to have good credit limit; when you have good credit, most financial institutions will provide you with additional pre-approved credit limit. This will lower the credit utilization below target 30%. With that being said, if you are someone who do not have the discipline or know how to manage your money, then spending excessively on non-essential things is certainly not a good idea.

I hope this information gives you the clarification and tips to keep a good credit score and how to improve/manage it in a more tactical way. At LifePlan Investments, we provide unbiased, simplified advice to manage your money, build your wealth and protect what is most important to you with the right insurance products.

If you need a second opinion on your current credit history or looking to rebuild your life, LifePlan certified consultants are always available to help you achieve your goals. Feel free to reach us to create a beautiful LifePlan for your family. You can also get a quick Quote here to start with.

Disclaimer: Do Your Own Research. You should take independent financial advice from one of our professionals and/or independently research and verify, any information that you find on our Website and wish to rely upon, whether for the purpose of making an investment decision or otherwise.