Child Insurance Plans

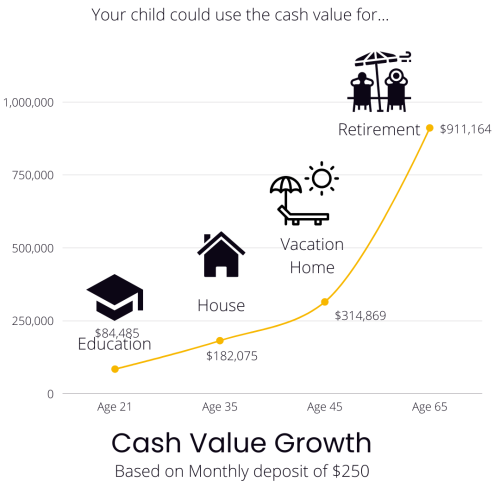

Child Insurance is the best way to invest & save for your child's or grandchild's future. It can help protect your family financially as well as provides your child an annual tax-free benefit which they can use for:

Education

First House

Vacation/Retirement

Any other Financial Need

Kids grow up fast, more than we think.

It’s important to plan and build their future with right foundation, including help them to manage their financial future.

Most parents think If I put RESP it will be enough! That’s not true!

Most successful families build a smart plan that help them beyond education, help them buy their first home, start a business or even help them with tax free retirement. Find out how you can help your child or grandchild with the smart plan.

Benefits of Child Insurance Plan

Cash values from Children Insurance plans can be used by your child for any financial need in their lifetime including education, down payment on a home, starting a business, even to provide financial security for their future family.

Start Early

You can open a Child Insurance Plan “PAR” Whole Life insurance plan for your child as early as 14 days after birth.

Easy to Open

Child Insurance Plans can be opened by parents, grandparents, aunts and uncles or legal guardians.

Permanent Coverage

Because Child Insurance is a Whole Life insurance plan, your child will be permanently covered.

Global Education

Cash values can be used for any university or vocational program around the world, not only those on the RESP Designated list.

Parents can COntrol

As their parent, you can control the use of the insurance cash values even after transferring it to your child.

No Future Deposits

Child Insurance is permanently funded after 20 years. No further deposits will ever be required.

Easily Transferable

You can transfer the Child Insurance tax-free to your child anytime after they turn 18.

For ANy FInancial NEed

Your child can use their Child Insurance cash values for any financial need in life.

Dividends to Deposits

You can use your Child Insurance annual dividends towards your annual deposits

Rising Tuition and Housing Costs

don't have to be a concern for your child

It is necessary to start saving and investing when your loved ones are still young to ensure that you accumulate sufficient funds to pay for their education or other financial needs.

We provide help in devising suitable strategies that you can use to save for your children.

Your Savings Benefit from Tax Free Growth

Unlike contributions made to a Registered Retirement Savings Plan (RRSP), savings in an RESP does not reduce your taxable income. However, all income and capital gains generated by your savings grow tax-free until they are withdrawn to pay for the cost of college, university, or trade school. As well as associated expenses such as boarding, lodging, and books.

PAR to save for Child's Education

When you buy a PAR policy on the life of your child, you can transfer ownership of the policy, including the assets in the policy to your child free of tax once he or she reaches age 18. Your child can then make withdrawals, that is, borrow from the policy, to pay for his/her education. As with an RESP, withdrawals will be taxable in the hands of your child, who will likely pay little or no tax while a student.

A higher rate of return that is contractually guaranteed, compared to a bank savings account.

Reduced potential for loss on investments.

Investments are less volatile compared to the financial market, this is because the institution guarantees the amount.

Lower interest cost of borrowing from cash value to fund education, compared to borrowing from a financial institution.

Cash value of the policy can be withdrawn for any purpose, including funding education costs, down payments, etc.

What Happens if You Miss a Payment?

Insurance for Children

There are many options you could have in place to ensure this situation is handled in an ideal manner.

You can make up the payment within the grace period or have your payment offset by future dividends (if qualified).

If the payment is too much for you, you can reduce the coverage, so that the payment will be lower.

If you decide to stop paying the premiums,

then you can get the accumulated cash

value back.

Want to Consult an Advisor First?

Talk to a dedicated non-commission advisor today.

Learn more various products get help to find what’s suitable for you.